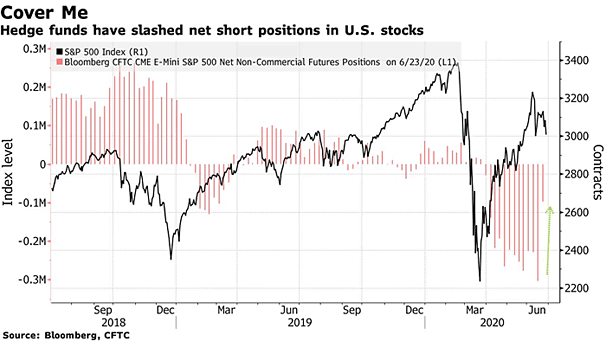

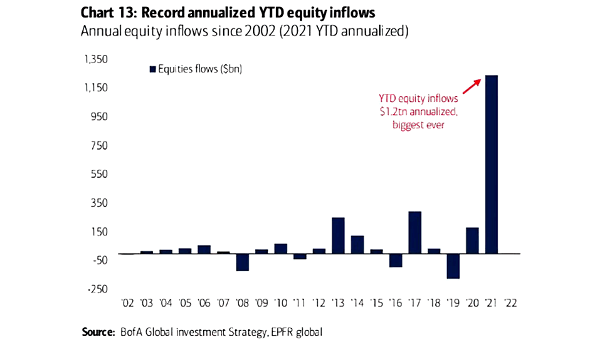

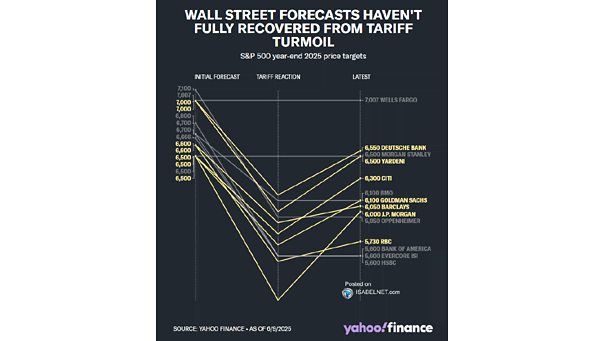

S&P 500 – Hedge Funds vs. Retail Investors

S&P 500 – Hedge Funds vs. Retail Investors The contrast between hedge funds taking short positions and retail investors being long is often seen as a warning of potential equity market weakness over the next one to three months. Image: Bloomberg