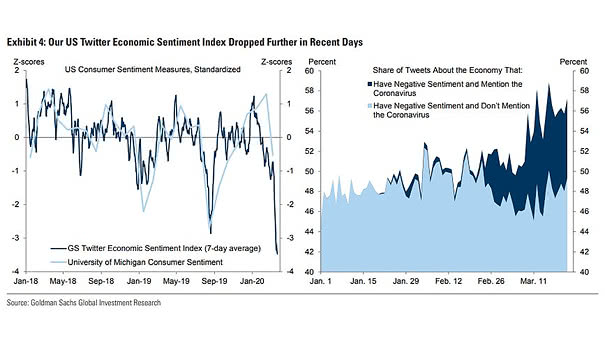

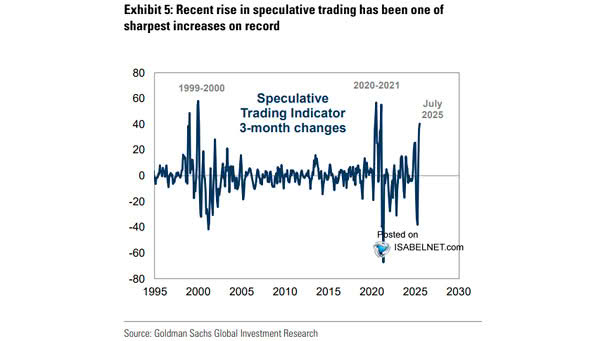

GS Social Media Economic Sentiment Index

GS Social Media Economic Sentiment Index Having rebounded from negative territory earlier this year, the GS Social Media Economic Sentiment Index recently surged to its highest level, indicating a significant positive shift in economic sentiment on social media. Image: Goldman Sachs Global Investment Research