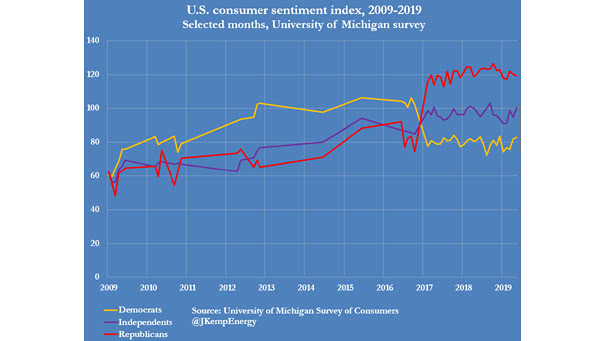

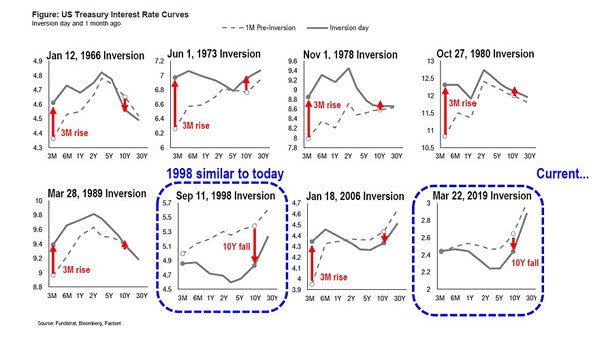

University of Michigan Consumer Sentiment Index – Democrats vs. Republicans

University of Michigan Consumer Sentiment Index – Democrats vs. Republicans This chart shows that Democrats and Republicans have a completely different view of the U.S. economy. Democrats see a recession coming and Republicans see economic growth. Image: John Kemp