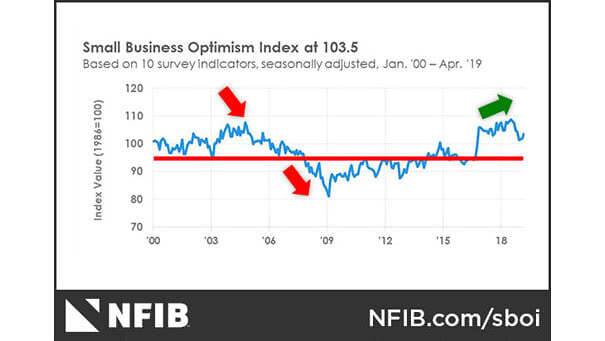

The “Small Businesses Optimism Index” Is a Good Recession Indicator

The “Small Businesses Optimism Index” Is a Good Recession Indicator This is not the perfect recession indicator, but when the Small Businesses Optimism Index falls below 100 or more likely below 95, then the risk of a recession remains high. And when the Small Businesses Optimism Index hits an all-time high, a recession may occur…