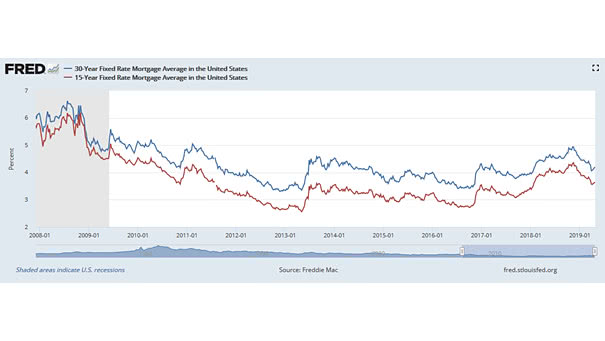

Is Residential Investment a Drag Since the Great Recession?

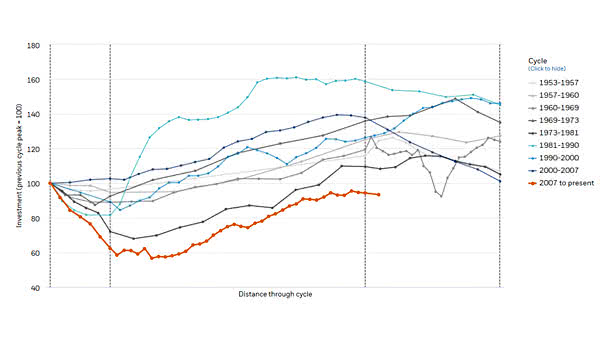

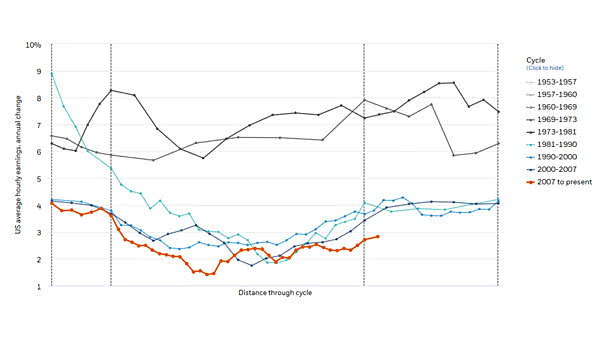

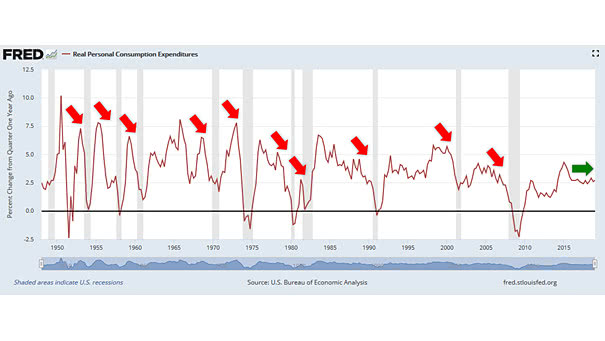

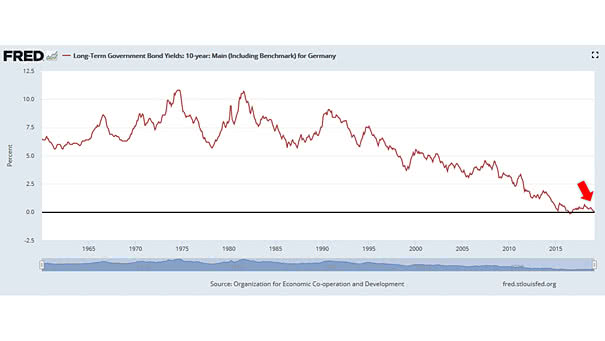

Is Residential Investment a Drag Since the Great Recession? Indeed, it is very low compared to other business cycles. And because housing is already in a slump relative to other economic cycles, it shouldn’t cause a recession. Image: Blackrock