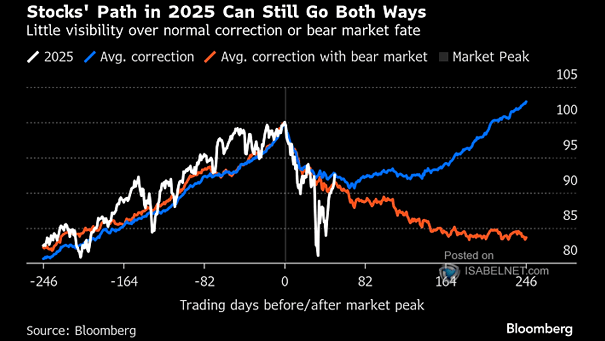

Average S&P 500 Performance During Corrections

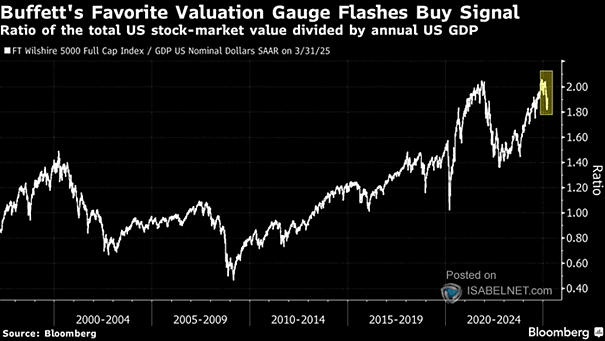

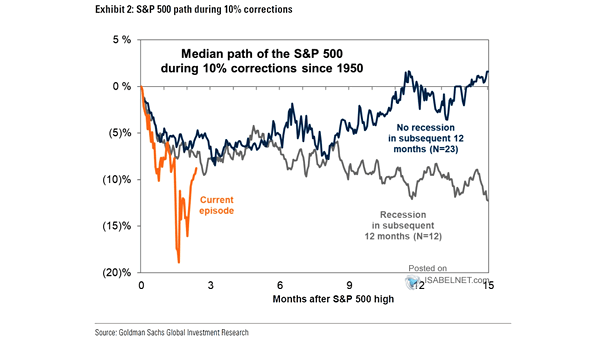

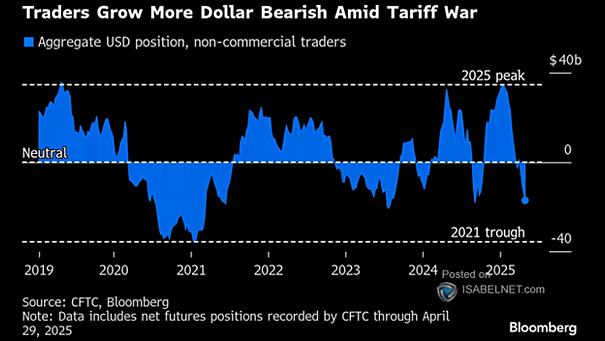

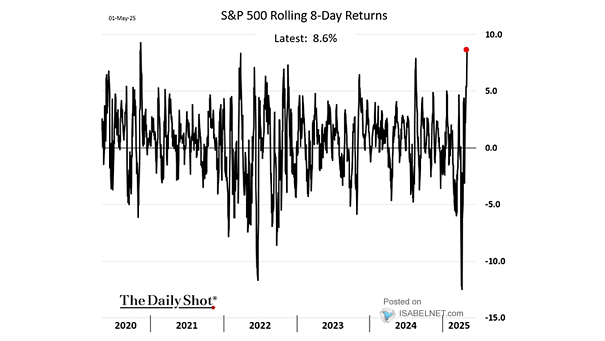

Average S&P 500 Performance During Corrections In bear markets, sharp rallies are common but rarely signal a true bottom, as the primary downtrend tends to reassert itself afterward. Many investors believe the direction of U.S. stocks in 2025 remains uncertain. Image: Bloomberg