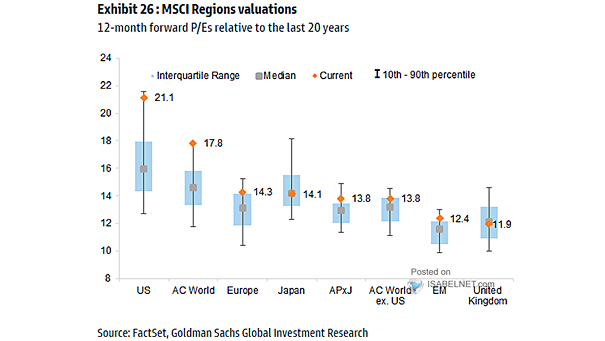

Valuation – 12-Month Forward P/E Ranges (MSCI Regions)

Valuation – 12-Month Forward P/E Ranges (MSCI Regions) Wall Street’s rally, powered by tech and AI euphoria, shows no signs of slowing—but soaring valuations and bubble talk leave little margin for errors despite the optimism. Image: Goldman Sachs Global Investment Research