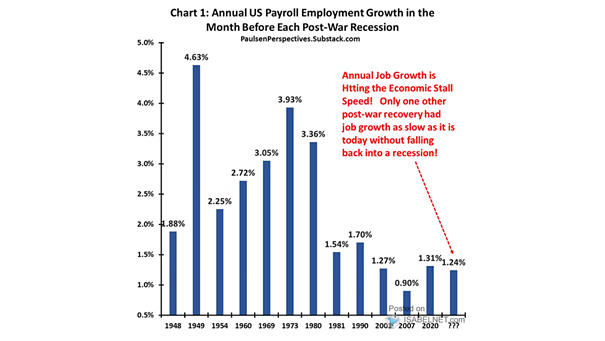

Annual U.S. Payroll Employment Growth in the Month Before Each Post-War Recession

Annual U.S. Payroll Employment Growth in the Month Before Each Post-War Recession The recent slowdown in U.S. job creation is concerning, as it nears levels typically seen before economic downturns. Image: Paulsen Perspectives