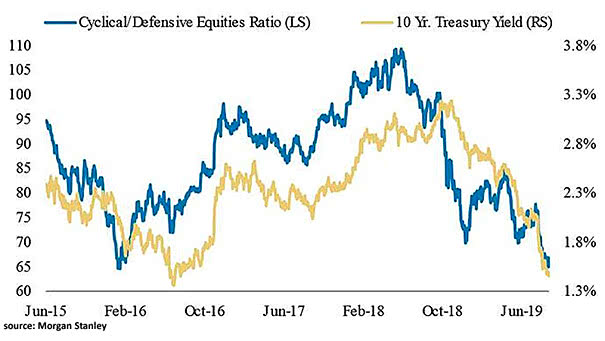

Cyclical/Defensive Equities Ratio and 10-Year Treasury Yield

Cyclical/Defensive Equities Ratio and 10-Year Treasury Yield The chart shows the correlation between the cyclical/defensive equities ratio and the 10-year treasury yield, signaling an economic slowdown. Image: Morgan Stanley Research