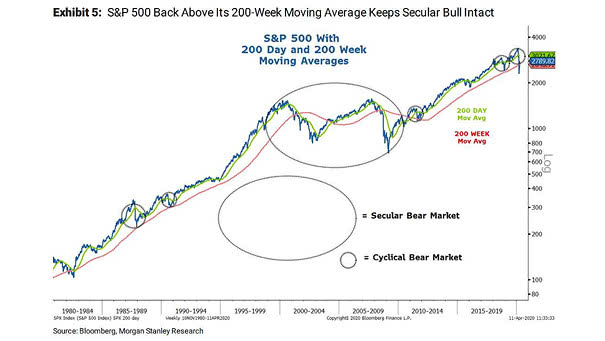

Secular Bull Market – S&P 500 with 200-Day and 200-Week Moving Averages

Secular Bull Market – S&P 500 with 200-Day and 200-Week Moving Averages This chart suggests that the secular bull market is intact, as the 200-week moving average is a strong support level. Image: Morgan Stanley Research