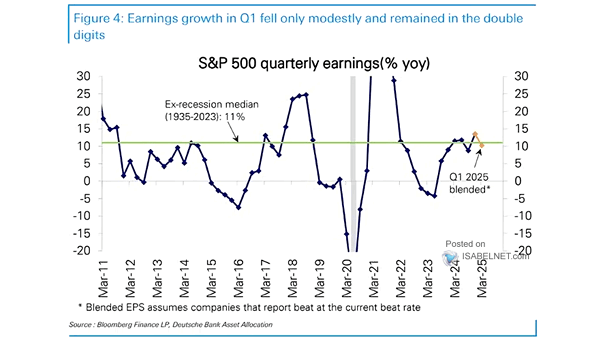

S&P 500 Quarterly Earnings Growth

S&P 500 Quarterly Earnings Growth Deutsche Bank sees S&P 500 earnings gaining momentum, with Q4 profits projected to jump 15% yoy, driven by supportive macro conditions and stronger corporate results, outpacing consensus estimates. Image: Deutsche Bank Asset Allocation