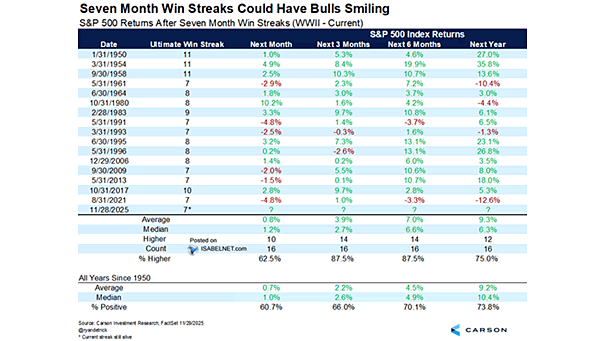

S&P 500 Returns After Seven Month Win Streaks

S&P 500 Returns After Seven Month Win Streaks Seven winning months in a row? Since 1950, the S&P 500 has pulled that off 16 times and history says momentum like this rarely cools: nine out of ten times, the rally kept rolling over the next 6 months, posting an average 7% gain. Image: Carson Investment…