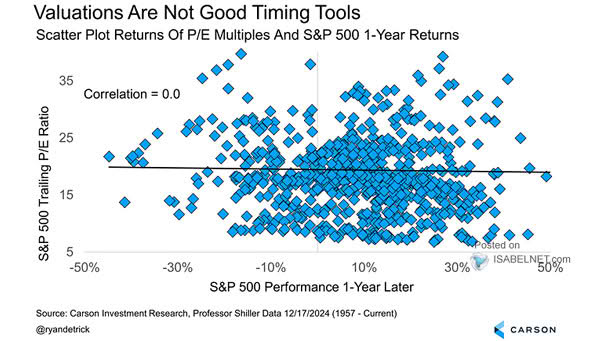

Scatter Plot Returns of P/E Multiples and S&P 500 1-Year Returns

Scatter Plot Returns of P/E Multiples and S&P 500 1-Year Returns The weak link between the P/E ratio and the S&P 500’s one-year performance shows why investors are better off keeping their eyes on the long game, not short-term valuations. Image: Carson Investment Research