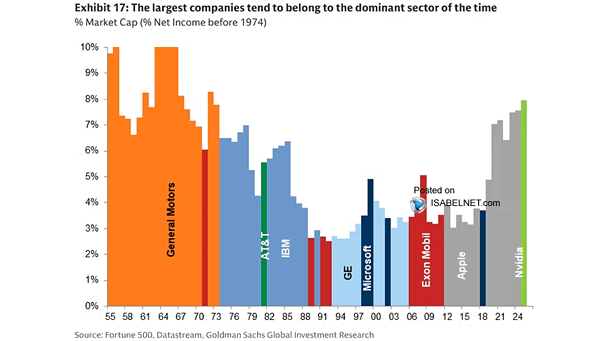

Largest Company in Terms of Market Value in the S&P 500 in Each Year Since 1955

Largest Company in Terms of Market Value in the S&P 500 in Each Year Since 1955 The market’s biggest players usually cluster in the sector riding the economic zeitgeist—and right now, that’s tech. It’s where innovation happens, growth speeds up, and investors chase the next breakout story. Image: Goldman Sachs Global Investment Research