How Does President Trump’s Twitter Use Impact the US Stock Market?

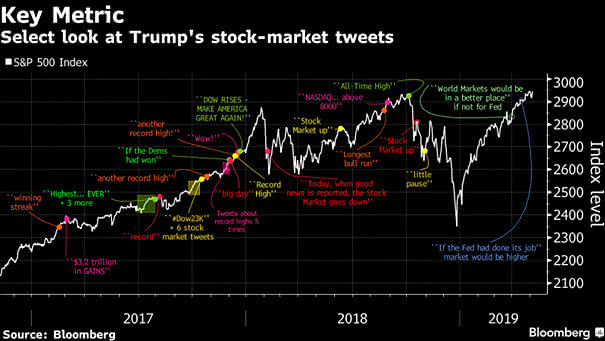

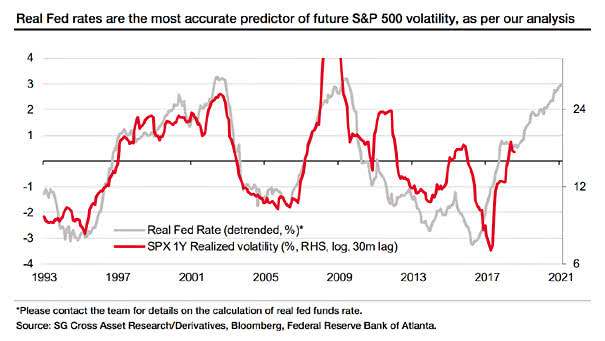

How Does President Trump’s Twitter Use Impact the US Stock Market? Trump’s tweets exacerbate short-term volatility and can create unpredictable short-term market fluctuations. That’s the reason why Warren Buffett stays focused rightly on the long term. Image: Bloomberg