Why the Current Business Cycle Can Continue?

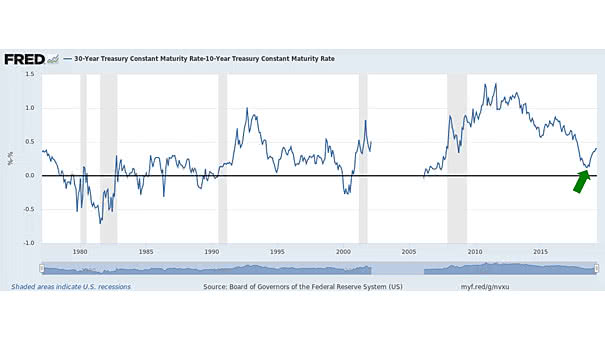

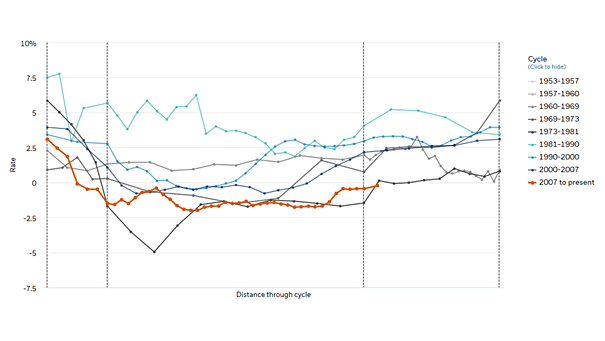

Why the Current Business Cycle Can Continue? Even if we are in a late business cycle, real Fed funds rate is near zero, the Fed remains “patient” at the moment and has little influence on the long end of the yield curve. The 30-Year Treasury Rate minus 10-Year Treasury Rate spread has a normal upward…