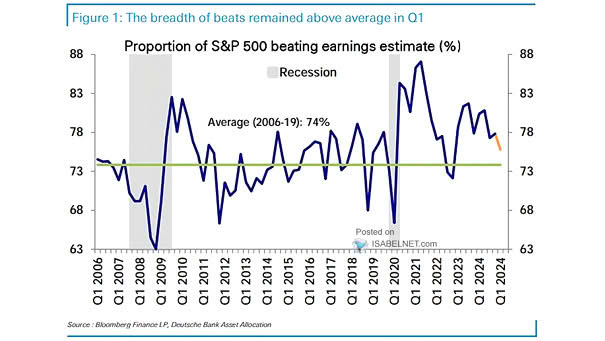

Proportion of S&P 500 Beating Earnings Estimate

Proportion of S&P 500 Beating Earnings Estimate Earnings resilience isn’t fading yet. More S&P 500 companies beating earnings estimates than average is keeping optimism alive and fears of a slowdown at bay—exactly the melody bulls want to hear. Image: Deutsche Bank Asset Allocation