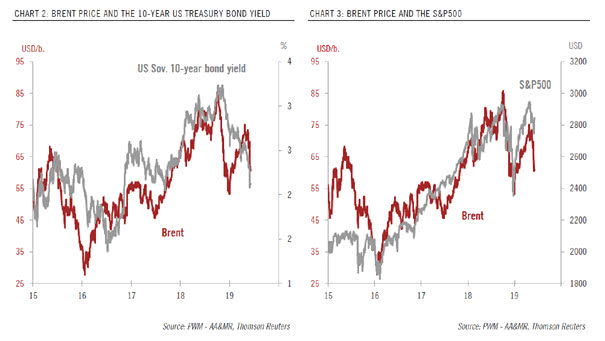

Brent Price vs. 10-Year Treasury Bond Yield vs. S&P 500

Brent Price vs. 10-Year Treasury Bond Yield vs. S&P 500 This chart shows that oil prices are a good indicator of global economic growth and investors are concerned about a global economic slowdown. Image: Pictet Wealth Management